The “Where did my money go?” moment

It’s December. You open your bank account, expecting… well, something. But the number staring back at you doesn’t match the mental math you’ve been doing all year.

You earned decent money. You didn’t buy a car or take an international trip. Yet somehow, your savings look suspiciously similar to January’s balance.

Where did it all go?

If this sounds familiar, you’re not alone. Most of us end the year with this exact question. We remember the big purchases — the laptop, the festival shopping, maybe that weekend getaway. But the rest? It’s a blur of coffee runs, food deliveries, and “just this once” impulse buys that happened… every week.

Here’s the good news: feeling confused about your spending doesn’t mean you’re bad with money. It just means you haven’t been tracking it. And that’s fixable.

Why a year-end expense review actually matters

A year-end financial review isn’t about guilt or regret. It’s about clarity.

When you look back at where your money went, you:

- Spot silent money leaks — subscriptions you forgot, habits that quietly drain your wallet

- Make next year’s goals realistic — no more “I’ll save 50% of my income” promises that crash by February

- Reduce money anxiety — knowing where your money goes feels way better than guessing

- Turn estimates into facts — “I think I spend ₹3,000 on food” vs “I actually spent ₹8,000”

Think of it as a health checkup, but for your wallet. You’re not looking for problems to beat yourself up over — you’re looking for patterns to understand.

How to do a simple year-end expense review (step-by-step)

Don’t worry — this won’t take all weekend. Here’s how to do a quick, practical review without getting overwhelmed.

Step 1: Collect your data

Gather your spending sources:

- Bank statements (download from your banking app)

- UPI transaction history (Google Pay, PhonePe, Paytm)

- Credit card statements

- Cash spending (even rough estimates count)

You don’t need perfect records. Close enough works.

Step 2: Categorize your spending

Group expenses into broad categories:

- Food & dining (groceries, restaurants, food delivery)

- Rent & utilities (electricity, internet, phone bills)

- Travel (fuel, public transport, cabs, trips)

- Subscriptions (Netflix, Spotify, gym, apps)

- Shopping (clothes, gadgets, home stuff)

- Miscellaneous (everything else)

Keep it simple. You’re looking for patterns, not building a spreadsheet empire.

Step 3: Identify patterns

Now comes the interesting part. Look for:

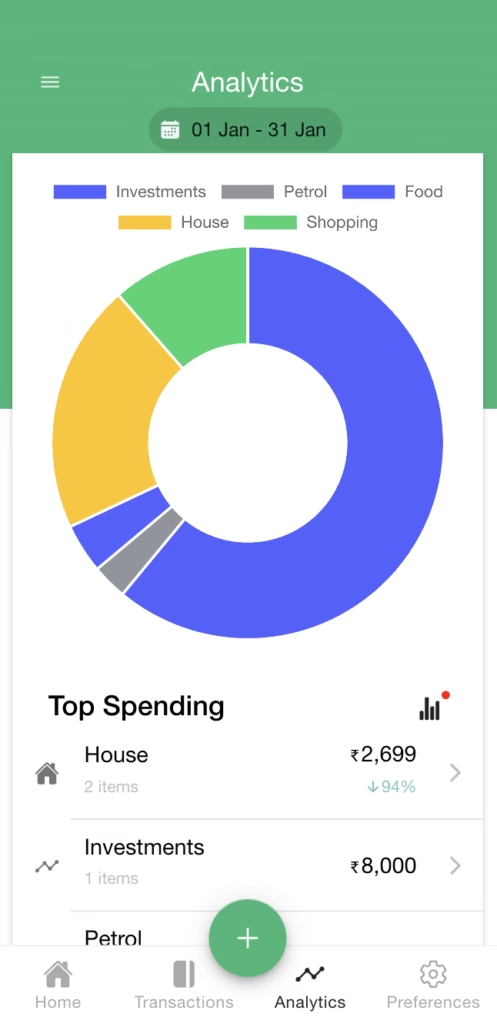

- Top 3 spending categories — where does most of your money go?

- Monthly spikes — did you overspend during festivals, sales, or vacations?

- “Wait, really?” moments — expenses that surprised you when you saw the total

For example: “I spent ₹15,000 on food delivery this year?!” (Yes. Yes, you probably did.)

Step 4: Ask the right questions

This is where reflection happens. For each major category, ask:

- What was worth it? (Maybe those weekend trips actually recharged you)

- What felt unnecessary? (Do you even watch that streaming service anymore?)

- What can I reduce next year? (Not eliminate — just reduce)

Be honest, but kind to yourself. You’re not on trial here.

Common mistakes to avoid

When doing a year-end financial review, watch out for these pitfalls:

- Being too harsh on yourself You spent money on things you enjoyed. That’s okay. The goal isn’t to never spend — it’s to spend consciously.

- Ignoring small expenses ₹50 here, ₹100 there — they seem tiny, but they add up fast. A daily ₹80 coffee is ₹2,400 a month, ₹28,800 a year. Not judging, just saying.

- Trying to track everything perfectly Perfectionism kills progress. If you can’t remember every cash expense from March, move on. Close estimates are good enough.

- Giving up halfway Reviews feel boring until you spot a pattern that clicks. Push through the initial drag — the insights are worth it.

How an expense tracker makes this effortless

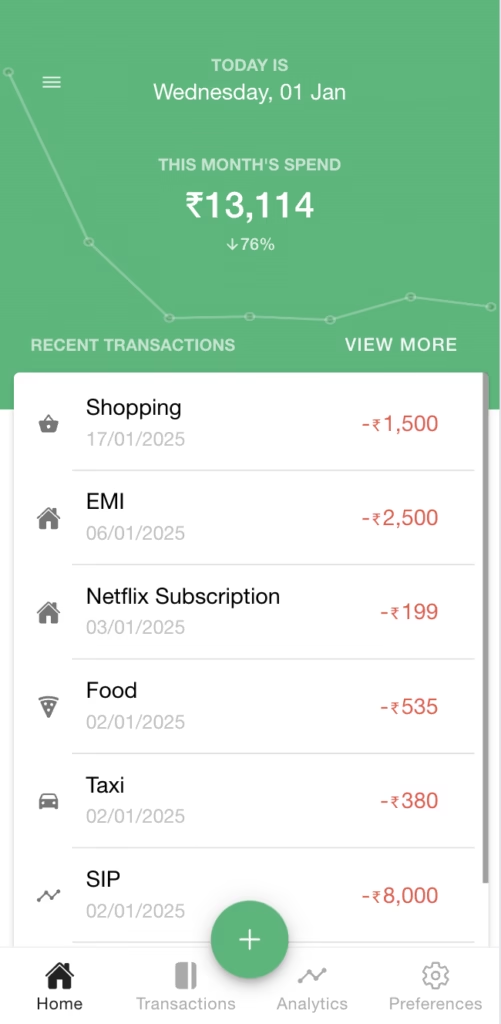

Here’s the truth: doing this manual review once a year is exhausting.

You dig through months of transactions, try to remember what “GPAY-12738” was for, and squint at tiny bank statement fonts. By the time you’re done, you’re too tired to actually use the insights.

That’s where expense tracking throughout the year helps.

When you track expenses as they happen:

- Patterns become visible automatically (no year-end detective work)

- You catch problems early (like that forgotten subscription charging you monthly)

- Year-end reviews take 10 minutes instead of 3 hours

- You actually remember what you spent money on

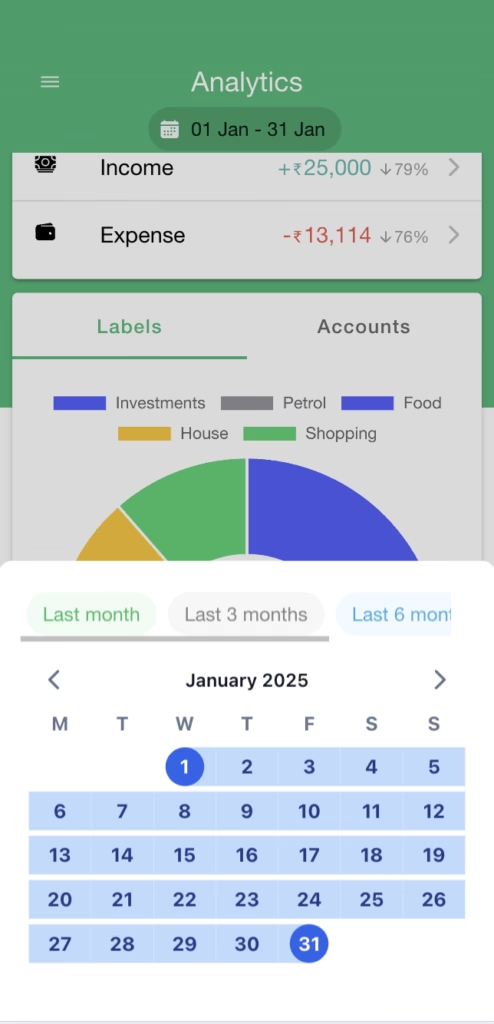

This is where tools like Expenzey come in handy. It’s a simple, free expense tracker designed for exactly this — quick daily logging that makes year-end reviews painless. Add an expense in seconds, assign labels that make sense to you, and your spending data organizes itself.

No complex budgets. No overwhelming features. Just a clear picture of where your money goes.

Looking ahead: use this review to plan next year

Now that you know where your money went, let’s talk about where it could go.

Set 2–3 realistic money goals for next year:

- Save ₹500 more per month (not ₹10,000 overnight)

- Cut one unused subscription

- Cook twice a week instead of ordering in

Notice the theme? Small, specific, doable.

Big dramatic goals (“I’ll save 50% of my income!”) crash hard. Small monthly improvements actually stick.

Track progress, not perfection: You’ll have expensive months. Festivals happen. Friends get married. Life costs money. That’s normal.

The goal isn’t to become a spending robot. It’s to spend consciously — knowing where your money goes and choosing where it goes next.

Start small, start now

A year-end expense review doesn’t have to be complicated. Look back, learn something, adjust forward.

And if you want next year’s review to be easier? Start tracking small expenses today.

Even just a week of tracking gives you more clarity than months of guessing. Try Expenzey if you want something simple and free to get started — it’s built for people who want clarity without complexity.

Your future self will thank you for it.