The reality check

It’s the first week of January, and your new year money resolutions are already feeling… shaky.

You started strong. You promised yourself this would be the year you’d save more, spend less, and finally get your finances together. But then life happened. A friend’s birthday dinner. An unexpected bill. That one “small” online purchase that somehow turned into three.

Sound familiar?

Here’s the truth: you’re not failing. You’re just making the same mistakes most people make when setting financial goals. The good news? These mistakes are easy to fix once you know what they are.

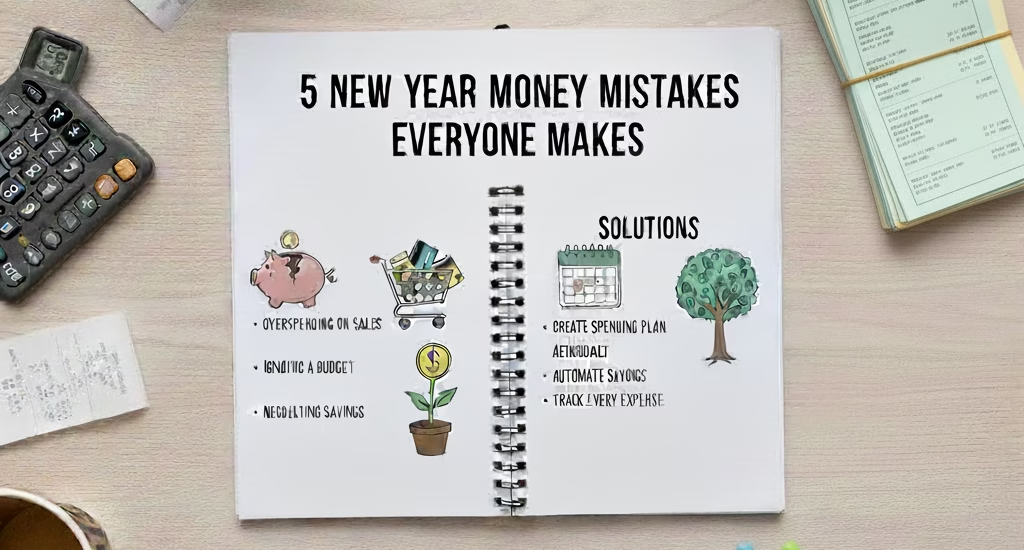

Let’s break down the 5 most common new year money mistakes—and what to do instead.

Mistake #1: Setting unrealistic savings goals

The mistake:

“This year, I’m going to save 50% of my income!”

It sounds ambitious. It feels motivating on January 1st. But by mid-month, when rent is due and groceries cost more than expected, that 50% goal feels impossible. So you give up entirely.

Why it fails:

Extreme goals work in motivational quotes, not in real life. When goals are too far from your current reality, even small setbacks feel like total failures.

What to do instead:

Start with small, achievable increases.

If you saved ₹2,000 last month, aim for ₹2,500 this month. Not ₹10,000. According to financial planning experts, incremental progress builds sustainable habits better than dramatic overhauls.

Realistic goal formula:

- Look at last year’s average monthly savings

- Add 10-20% to that number

- Adjust every quarter based on what’s working

Small wins compound. By December, you’ll be surprised how much that ₹500 monthly increase added up to.

Mistake #2: Tracking everything perfectly (or not at all)

The mistake:

You download an expense tracker, spend an hour categorizing every transaction from the past month, create 47 different expense categories. By week two, you’re exhausted and stop tracking altogether.

Or the opposite: you don’t track anything because “I’ll remember” or “it’s too much work.”

Why it fails:

Perfectionism kills progress. When tracking feels like a part-time job, you won’t stick with it. But when you track nothing, you’re flying blind—and money disappears without you noticing.

What to do instead:

Track the big stuff consistently, not everything perfectly.

Focus on:

- Major purchases (anything over ₹500)

- Recurring expenses (subscriptions, bills)

- One or two “watch” categories (like food delivery or shopping)

Studies from personal finance researchers show that people who track even 60-70% of expenses make better financial decisions than those who track nothing.

The 5-second rule: If logging an expense takes longer than 5 seconds, your system is too complicated. Simple beats comprehensive every time.

Tools like Expenzey are built for this—quick entry, custom labels, no overwhelm. Track what matters in seconds, not hours.

Mistake #3: Comparing your progress to others

The mistake:

You see someone on social media talking about their “₹5 lakh savings at 25” or their “debt-free journey.” You look at your own bank balance and feel like you’re failing.

So you either give up (“I’ll never catch up anyway”) or make impulsive decisions trying to match their pace.

Why it fails:

You don’t know their full story. That person might have family support, no rent, a higher income, or fewer financial responsibilities. Comparing your chapter 3 to someone else’s chapter 20 is pointless.

What to do instead:

Compare yourself to your past self, not to strangers online.

Ask instead:

- Am I better with money than I was six months ago?

- Did I make one smart financial decision this week?

- Am I learning, even if slowly?

Progress isn’t linear. Some months you’ll save more, some months less. What matters is the overall direction, not month-to-month perfection.

Mistake #4: Ignoring small expenses (because “it’s just ₹50”)

The mistake:

“It’s just a coffee.”

“It’s only ₹80 for delivery.”

“This snack is barely ₹60.”

Individually, these expenses feel tiny and harmless. So you don’t track them, don’t think about them, and definitely don’t count them in your budget.

Then suddenly it’s month-end, and ₹6,000 is just… gone.

Why it fails:

Small expenses are silent budget killers. A ₹60 coffee five times a week = ₹1,200/month = ₹14,400/year. That “just ₹80” food delivery three times a week? ₹10,000+ annually.

Not saying you shouldn’t enjoy these things—but you should know they’re happening.

What to do instead:

Make small expenses visible.

You don’t have to eliminate them. Just track them for one week. See the pattern. Then decide consciously.

Maybe you realize:

- Weekend coffee with friends = worth it

- Solo 11 PM food delivery out of laziness = not worth it

Financial advisors consistently note that awareness alone reduces unnecessary small spending by 15-20%, without restrictive budgeting.

When you track with something simple like Expenzey, those ₹50 expenses take 5 seconds to log—and suddenly you can see where ₹6,000 went.

Mistake #5: Giving up after one “bad” spending day

The mistake:

You have one expensive weekend. Maybe a friend’s wedding, an emergency purchase, or just a moment of weakness during a sale. You blow your budget.

And then you think: “Well, January is ruined. I’ll start fresh in February.”

So you stop tracking, stop trying, and spend the rest of the month without any financial awareness.

Why it fails:

One overspending day doesn’t ruin a month any more than one salad makes you healthy. But giving up for three weeks absolutely does derail your progress.

What to do instead:

Reset daily, not monthly.

Had an expensive Saturday? That’s okay. Sunday is a fresh start. Log what you spent, understand why, and move forward.

The 80/20 rule for money: If you make good decisions 80% of the time, the occasional 20% splurge won’t wreck your finances. Consistency beats perfection.

Think of it like this: Missing one workout doesn’t mean you quit the gym. One expensive day doesn’t mean you quit financial goals.

According to behavioral finance research, people who practice self-compassion around money mistakes actually stick to their goals longer than those who shame themselves.

The real secret: consistency over intensity

Notice a pattern in all these mistakes?

They’re all about trying too hard, too fast, too perfectly—and then burning out.

The people who actually improve their finances in 2026 won’t be the ones with the most extreme resolutions. They’ll be the ones who:

- Track consistently (even imperfectly)

- Adjust goals as they learn

- Forgive themselves for slip-ups

- Make small improvements month after month

New year money mistakes aren’t about being bad with money. They’re about approaching change the wrong way.

How to stay on track (simple habits that work)

Here’s what actually works for sustainable financial progress:

1. Track something every day

Even if it’s just your top 3 expenses. Build the habit first, perfect the system later.

2. Review weekly, not just monthly

Spend 5 minutes every Sunday checking your week. Small course corrections beat big month-end surprises.

3. Celebrate small wins

Saved ₹300 more than last month? That counts. Caught an unused subscription? That’s a win. Progress is progress.

4. Use tools that reduce friction

Manual tracking is exhausting. Apps like Expenzey make it effortless—add expenses in 5 seconds, see patterns automatically, stay aware without the spreadsheet stress.

5. Remember: it’s a year-long game

January doesn’t define your whole year. One good financial decision today is better than ten perfect resolutions you’ll abandon by February.

Your January doesn’t have to be perfect

If you’ve already made some of these mistakes this month—welcome to the club. So has almost everyone else.

The difference between people who reach their financial goals and those who don’t isn’t avoiding mistakes. It’s what they do after making them.

You didn’t fail. You learned. Now adjust and keep going.

Ready to make the rest of January (and 2026) better?

Start simple: track one expense category this week. Just one. See what you learn. Tools like Expenzey make this ridiculously easy—no complex setup, no overwhelm, just quick tracking that actually helps.

Because the best time to start was January 1st. The second-best time? Right now.

What’s one money mistake you’re fixing this month? (Honestly, we’ve all been there.)

Good post! We will be linking to this particularly great post on our site. Keep up the great writing